Stop Limit Order

Stop Limit Order

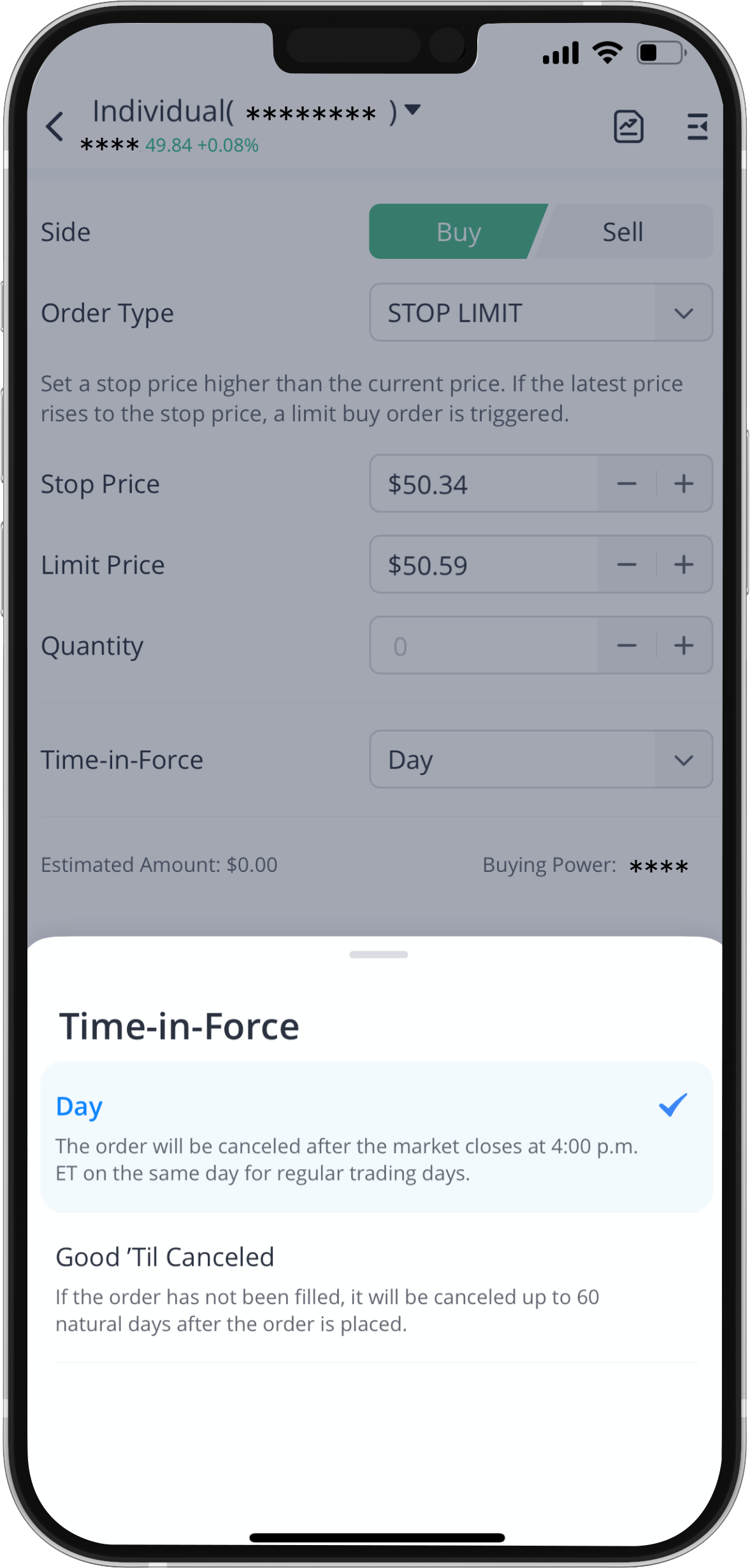

A stop limit order is similar to a stop order, except that the order is changed to a limit order upon triggering.When placing a stop limit order, two prices are entered: a stop price and a limit price. The order is triggered when the stock has traded at or through the stop price and then becomes a limit order.

- In a buy stop limit order, an investor enters the stop price above the current market price and sets the limit price as the highest price they are willing to pay for a share. For example, XYZ stock is currently trading at $12 per share. Investor A wants to buy XYZ shares when the price has reached $14, and she is willing to pay $14.5 per share at most. Therefore, she places a buy order with a stop price of $14 and a limit price of $14.5. Her order will be triggered only when the stock price hits $14 or above, and filled at $14.5 or below.

- In a sell stop limit order, the stop price is set below the current market price. The limit price is the lowest offer that an investor is willing to accept. For example, XYZ stock is currently trading at $12. Investor B worries that the price may drop significantly. He wants to sell his shares for at least $9.5 per share when the price drops to $10. Therefore, he places a sell order with a stop price of $10 and a limit price of $9.5. His order will be triggered only when the stock price drops to $10 or below, and filled at $9.5 or higher.

To sum up:

A stop limit order is triggered at the stop price and filled as a limit order.

It enables investors to have control over the execution time as well as the execution price of the order. However, similar to a stop order and a limit order, the order may never be filled if a certain price is not met.

Tips:

- On Webull, we support placing stop limit orders in both market and extended hours in stocks trading.

- You can choose a Day order if you only want your order to last for a day. If you want your order to last longer, use a Good ‘Till Canceled order, which will last for 60 days (including weekends and holidays).

0

0

0

Your capital is at risk. You may lose money on your investments. Terms and conditions apply.

Wall Street Journal

Wall Street Journal TradingView

TradingView