GTC vs Day Order

Introduction

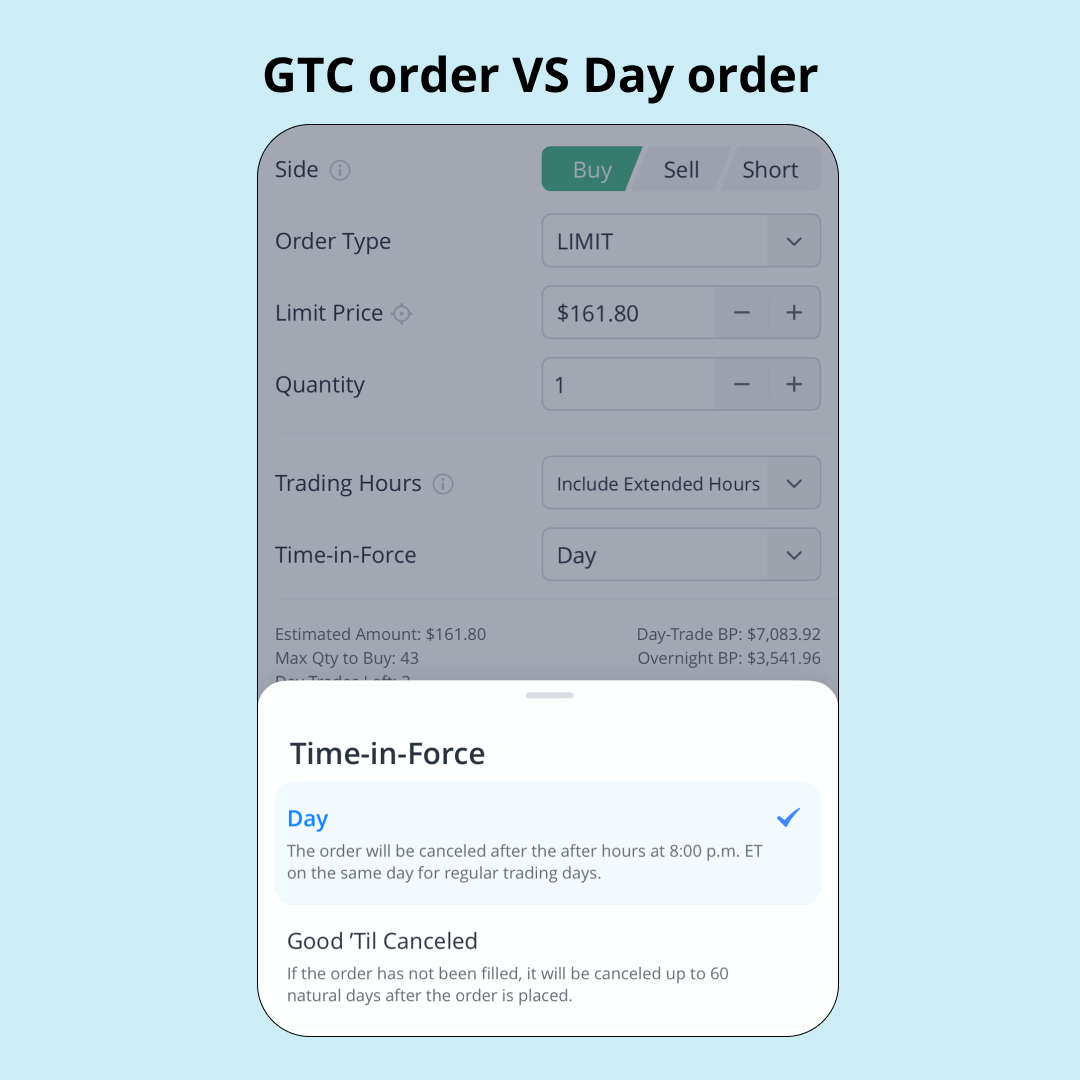

When you're placing an order, you have to choose a Time-in-Force—day or Good ‘Til Canceled (GTC). Let's figure out how to place them and what the differences are.

What is a Day Order?

The US stock market closes at 4:00 PM ET on trading days. If you choose a day order, all your pending working orders will be cancelled at 4:00 pm or 8:00 pm (if you choose to include the extended hours) if not yet be executed by then.

How to Trade with Day Orders

Suppose you want to invest in stock B, which is currently trading at a market price of $6.00. You place a limit order at $5.5. You choose a day order.

There are two possible scenarios:

- The price falls and reaches your limit price at $5.5 before 4:00 PM, and the order is filled at $5.5 or below.

- The price does not drop enough to trigger the limit order. Your pending order will be cancelled automatically at 4:00 PM.

A day order provides you with more flexibility to control your order placing. If you are worried the market will be too volatile on the next trading day, you can wait before deciding whether to adjust the price or not place the order.

What is a GTC Order?

A GTC order lasts until the order is completed or cancelled. Generally, all open GTC orders expire 60 calendar days after they are placed on Webull. You can place GTC orders during both regular trading hours and extended hours (from 4:00 am to 8:00 pm EST on business days), and you can modify or cancel your open GTC orders anytime.

Please note, in the event of any corporate action (stock split, exchange for shares, or distribution of shares), all open GTC orders will generally be cancelled.

How to Trade with GTC Orders

Example

Suppose you want to invest in stock B, which is currently trading at a market price of $6.00. You place a limitorder at $5.5. You choose a GTC order.

There are two possible scenarios:

- Market price falls below $5.5 to trigger your limit order in 60 days. The order will be filled at $5.5 or below.

- The market price keeps rising and fails to reach $5.5. The pending order will expire automatically after 60 days.

The Bottom Line

- If you want your order to last for only a day, use a day order. You can always place the order again at your convenience on the next day.

- If you want your order to last longer so that you don't need to place it multiple times, use a GTC order. You can cancel or modify the order any time before it is filled.

Wall Street Journal

Wall Street Journal TradingView

TradingView